Weighing Risks

The “Invincible” Spanish Armada being broken up in a storm off the coast of Ireland after being defeated by England in 1588

Please read this with an open mind. I have been long both bitcoin and ethereum since 2016. The point of this dispatch is to show my thought process for evaluating the environment I find myself in for what I think it is instead of what I would like it to be, weighing most likely and most deadly outcomes, and not letting noise paralyze me from thinking clearly, making decisions, and moving forward in an unknown environment.

Having a process is more important than the decision because you have to keep solving problems in the midst of the unknown. This is why I focus on looking at the big picture first, then I take it down one level to look at variables and weigh most likely/most deadly, then really dial it in to how does outcomes affect me personally.

If you do not agree with my outcome, or even my thought process, no worries, just hope it helps you to think about forming your own process that you can use for success in life. Take what works, leave what doesn’t, because no matter where you fall on what investments you hold, I wish all of you nothing but the absolute best so you can keep doing good work and making a positive difference for those who depend on you to do the right thing admist the unknown.

- RC

The Big Picture

Twelve years after Spanish sailors went into an ink black sea, their screams silenced by the shrieking storm as if Valkyries overhead were taking their chosen and leaving the survivors to be washed upon a barren Irish shore, English privateers cruised offshore of the Americas, funded by well connected merchants all the way to the Queen herself, and plundered the Spanish Main.

Despite England being the major sea power, Spain would stay a hemisphere spanning power, their convoy doctrine keeping their treasure fleets safe, the first global trade route of their kind.

But imagine for a moment, instead of two western powers battling for dominance and trade, where aristocrats and military commanders on both sides learned military doctrine originating from chess, a game of feints, blocks, retreats, direct attack, and sacrifices, one side instead was steeped in the Chinese way of war, or total warfare, which is taught in the game of go.

In go, you win by surrounding your opponent and leaving him without a move, the point is control, then attacking weak points, not to kill them in conflict, but slowly building pressure to deny your opponent the ability to gain territory or influence until they have no moves left.

What would this struggle for power in the 16th century look like if the Spanish were schooled in the eastern art of total warfare, where attacking economic, political, and social parts of their enemy are legitimate moves in war?

This new Spanish doctrine would have applied pressure to England’s economy, politics, and society until England was too fractured to use their naval power, effectively neutralizing a superior military force by removing the will to fight from their society before they even knew they were at war.

To start the Spanish Crown would have seen the dominance of the oceans from English privateering, and encouraged all merchants to switch to English ships, putting the sole cost of operations, insurance, and military protection of trade on England.

In total warfare doctrine, the next priority for Spain would be to find a way to stop paying fair price to move their goods. Practicing free trade in total warfare helps your enemy, and the goal of the Spanish Crown is to dominate the New World.

The Spanish Crown decides instead of paying English merchants in silver from their Peruvian mines, they will pay in English pounds. England is delighted at this development, however what they do not know, is in secret, the Spanish have turned Nassau into a massive counterfeiting operation where they keep the islands population enslaved so knowledge of the operation does not escape.

Rumors swirl of course, occasionally a slave escapes and tries to tell the tale of horror that is their life and of those left behind in bondage, but the Spanish crown is smart. While Catholic, the crown makes sure to seek out and by blackmail or bribe, slowly infiltrate English Protestant society including Aristocrats, Politicians, Merchants, Clergy, and Newspapers so that when these rumors of counterfeit start to surface, the corrupt among England’s high society quickly do as their Spanish masters instruct and gaslight, deny, discredit, or drown out the truth with enough disinformation English society cannot tell truth from the noise, and think surely if an English Protestant is defending a Spanish Catholic then it must be so, and go back to their daily lives. Intentionally deceived by the corrupt amongst them to the very real economic threat now posed by the Spanish crown to their way of life.

The Spanish are now able to quickly ramp up treasure fleets, shipping goods for essentially free between their colonies in the east and west Indies back to Europe, and exporting goods from Spain to their colonies, all while their enemy, the English Navy oblivious to the insidious threat posed, protect Spanish trade and takes worthless counterfeit pounds for their sacrifice.

But the Spanish are not done weakening the English economy, they start using the real silver from mining operations to buy resources and build alliances in Europe, effectively leveraging their economic warfare against England into a dominating political, diplomatic, and military strategy.

The Spanish then open a new offensive on the political front of their total warfare strategy. Using their network of corrupt English elite, which the English populace does not suspect are secretly working for the enemy, these corrupt English politicians, newspapers, merchants, and aristocrats start telling their circle of friends how much they admire the Spanish culture, how advanced the Spanish treasure fleet system of global trade is, and how it is only a matter of time until the Spanish, not the English, are the dominant power in the New World.

English society is confused, they cannot quite understand why things are starting to go wrong. They are the unchallenged masters of the seas, the Spanish are participating in free trade, yet things are not going well in England, the counterfeit currency entering the Empire that fuels Spain’s growth is starting to take the toll. People are losing jobs, their cost of living is going higher, and the Elites they trust to protect their society are saying all of this is good for England, while those at court continue to enrich themselves, and the wealth gap in England becomes extravagant as the Spanish crown wages total war against England’s population which still thinks wars are played as a game of chess.

The Spanish crown, pleased the economic and now political fronts in their total warfare campaign are going well start to attack another weak point in the political structure of England. The Spanish crown pays their English traitors to start prosecuting English Catholics, which are the minority in the country, giving their Protestant supporters in the majority, who at this point want someone to be held responsible for why thing are going wrong in England, a convenient target for their anger - their neighbor.

In total war, what better way to start breaking the binds that hold a country together than turning neighbor against neighbor?

As English protestants start to persecute their neighbors in the minority, and Catholics who are being wrongfully targeted, victims of Spain’s total warfare as much as their neighbor who is being influenced by the corrupt English, the Spanish Crown comes to the defense of the English Catholics, saying to the world, don’t you see, this is how the world power treats their minorities!

The total warfare strategy being waged by the Spanish crown has now removed all the economic and political moves which England can make. Meanwhile the English Navy sails unchallenged on the open seas, dutifully protecting Spanish goods and taking counterfeit currency as the Spanish grow stronger.

English society becomes disillusioned, those in the military and diplomatic corps want desperately for their beloved country to play a game of chess before it is too late to crush this threat of oppression to the world.

But they are slowly realizing it was not just the economic and political moves being taken away by using the game of go against a society that plays chess, the very will and social cohesion of their country needed to play a game of chess is being destroyed as total war is waged against them.

As the disillusionment deepens because the English feel betrayed by those in power, there are now active groups forming within England wanting radical change, others are opting out completely, moving to far off colonies that promises free land in an effort to distance themselves from the rigged game that is now England as the Spanish Crown and corrupt English elites destroy their once great Empire from within.

The game is now almost complete and the Spanish open their last line of advance on English society itself, even sacrificing their own sailors to deliver the plague on Spanish ships to England. The plague quickly sweeps through England, jumping the channel and burning through the continent. The Spanish crown makes sure they too are seen to suffer the consequences by sacrificing portions of their peasantry. The furnaces burn hot for days.

When your view your entire population as slaves, there is no sacrifice unbearable for the Spanish crown in this game of total war.

English society now starts to unravel, with the Spanish crown placing their last marker on the board and the game of go is complete.

The proud English fleet cannot play their game of chess because England has no more moves left socially in the game of total war which was waged silently against them. The English corsairs sail for home, their empire and unparalleled naval force broken from within without a cannon shot being fired and the new game of New World domination under the crushing oppression of the Spanish crown dawns.

Welcome to warfare in the 21st century.

Most Likely, Most Deadly, My Favorite Game

The picture above is what we used overseas to help look at possibilities, and then chart their probability, weighting the risk in frequency against chance of total loss. I’d usually do this on a white board with other buddies to get their buy-in. The stressful part of risk for me is the unknown, by writing down all the risks we could think of, it takes the stress of the unknown out of the situation. Can then start managing risk for each of the things written down and you know where you need to focus your attention - most likely/most deadly.

Active risk management is critical to this process. You cannot just think about it, doing it “notionally” as we called it overseas. Not good enough.

Your brain unintentionally will trick you, you want yourself to succeed, so your brain unconsciously skips over unknown risks associated with your most likely/most deadly risks, By doing active risk management, you discover things which would have been single failure points resulting in total loss within that risk. We called it building in durability since we were betting our lives, and didn’t want an unknown factor within a risk to kill us.

For example, a week before Taliban hit us with a 5,000lb VBIED, we did a live air medevac drill with a gunship and medevac bird, going completely through the attack sequence, defense, stabilizing casualties, calling all clear to the gunship, medevac coming in, loading casualties, and them being flown to higher level care where they were received, and the hospital ran through their complete drill of receiving and treating casualties, with the drill ending when they were “stabilized” and I had received the count back at my camp with names and conditions for accountability. Complete run through the sequence of what we would do for a most likely/most deadly risk, to identify all unknown single point of failures we found in the sequence.

So what is an example of finding an unknown single point of failure by practicing active risk management?

When the gunship was inbound during the drill, I didn’t have comms from the ground, turns out they had changed their frequency and I didn’t have the new one. Rule is, until we call all clear on the ground and have security set, the gunship won’t clear the medevac bird in because you don’t want it going down hard in the HLZ and closing it.

I got the updated frequency after the drill, which meant a week later when two of my guys who were wounded urgent surgical, (would die without immediate higher care), we were able to get a medevac in immediately for them. Finding that unknown single point of failure saved two lives.

I’m using a pretty heavy example on this, but you can do this for anything, camping trip, road trip, an investment, whatever you got going on.

Sure you’ll make mistakes, but you learn, get better, and become more confident with experience to evaluate risks and work through how you want to manage it to reduce the stress of the unknown, evaluate risk, think about decisions, and act clearly admist all the noise of life.

Ok, so lets apply this to bitcoin.

Bitcoin

Now, this is just my risk management weighting on events for probability it occurs, and total loss if it does. If you have different risks identified, different weightings, think I’m totally wrong, absolutely no worries, it is all good, this is a very personal thing on what risks and consequences you are willing to accept if they happen.

Personally, I don’t think risk management fits into an equation, or an excel spreadsheet, and I would never be comfortable letting someone else do it for me. The real world is grey and mercurial, constantly shifting and the weight of managing risks in life is supposed to be heavy, that is the entire point of leadership and being personally responsible for yourself.

I was actually surprised I weighted the exchange hacks as low as I did or funds being lost, part of the reason I did that is have 2FA and white listing both enabled on the accounts I have. While I think exchange hacks and home invasion or being robbed in the street for my bitcoin are very low, the risk of serious injury and death during a violent encounter like a home invasion and robbery is substantially higher, which for me puts having a hardware wallet at home or carrying crypto on a mobile wallet a much higher risk scenario for what I evaluate as no additional protection in probability of event over an exchange hack. I get it, a lot of people will not like that, but this is all our own risk/reward weighting.

I also thought about if bitcoin goes higher, lets say it does hit six figures, and then over the next few years goes as high as $500k. Any person you told you had bitcoin, they have told people, and at some point it has ended up in the back of someone’s mind who is working a dead end job because they are a violent felon who cannot progress further up the socioeconomic ladder because of their prior choices in life who is going to do their own risk/reward calculations like I am here (You think only good guys do this?) and then decide the risk of being killed or going to prison is worth the potential reward of finding you and stealing your bitcoin.

So Opsec for the win always. Remember, deterrence is as good or better than direct action on risk management.

Now, lets talk about what I see as very high probability events.

Working left to right. If bitcoin replaces the dollar and becomes a world reserve currency, there won’t be any risk to loss, but I won’t want to live in that world.

I don’t hold it against anyone reading this if you want that to happen, if you are working towards it, or you think it is the correct answer. As far as I’m concerned, we are all on the same team because if you are reading this, your pain is my pain, I get it, I know why you are in it, hell I’ve been in it since 2016 and Afghanistan. I KNOW how wrong the system feels. I’ve been shoulder to shoulder right alongside you.

It has to do with some serious soul searching I’ve been doing recently. I don’t think I’m special, smart, and don’t even think I really know what I’m doing on finances, I’m just taking a model that kept me alive overseas and trying to use it on my money.

I’ve been overseas a lot of years, and I have been in situations where someone desperately needed my help and I couldn’t help them.

I don’t want to be in that situation holding bitcoin with the world tearing itself apart because the dollar is losing as the world trade currency and US hegemony is pulling back to the western hemisphere leaving everyone else to fend for themselves.

The 8 billion people on the planet can’t make it without us.

I’m not saying it is right, I’m not saying it is fair, and I’m not saying you have to do anything different than you are doing. I’m just saying I’m not cool sitting in a lifeboat while I watch people lose.

And look, no issue if you are sitting in the lifeboat, alright? I get it, we all got how much we can take. I walked away over two years ago, but I’m good now, I want to be tagged back in. Someone else can have my seat on the lifeboat if they want. I don’t want to live in a world where the dollar has fallen and the US is doing its own thing in the western hemisphere. Maybe I have to, but I at least want to plant the flag and build something.

I loved bitcoin for years, and I think it was because to me it was digital isolationism. I had lived a life of service and been betrayed. But I’m over it and ready to move forward again. No worries if you aren’t ready and want to stay in the boat, I get it, and I’m not judging. Take the time you need.

ETF’s

I still think ETFs are coming and Wall Street is going to run with it, Blackrock is in, the OCC is saying banks can use stablecoins, so not only are ETFs coming, but Eurodollar 2.0 is on the way as well.

In a way, large financial institutions do not have a choice.

The 60/40 portfolio that worked through the last 40 years while the Fed could pull the interest rate lever lower during times of market panic in order to buffer Boomer retirement portfolios is finished. That game is over. The lever is jammed all the way down almost to zero.

I think Blackrock and others are looking at bitcoin and crypto and seeing their salvation, now they can tell Boomers everything is ok, keep your 60% equities, take bonds to 35%, and put 5% bitcoin which has the ability to outperform and is uncorrelated to the market.

It is exactly the asset they need at exactly the right time they need it.

https://twitter.com/peterzeihan/status/998577762964328450

Chinese Communist Party

Problem is the more I thought about this, bitcoin is exactly the right asset at exactly the right time for the CCP, too.

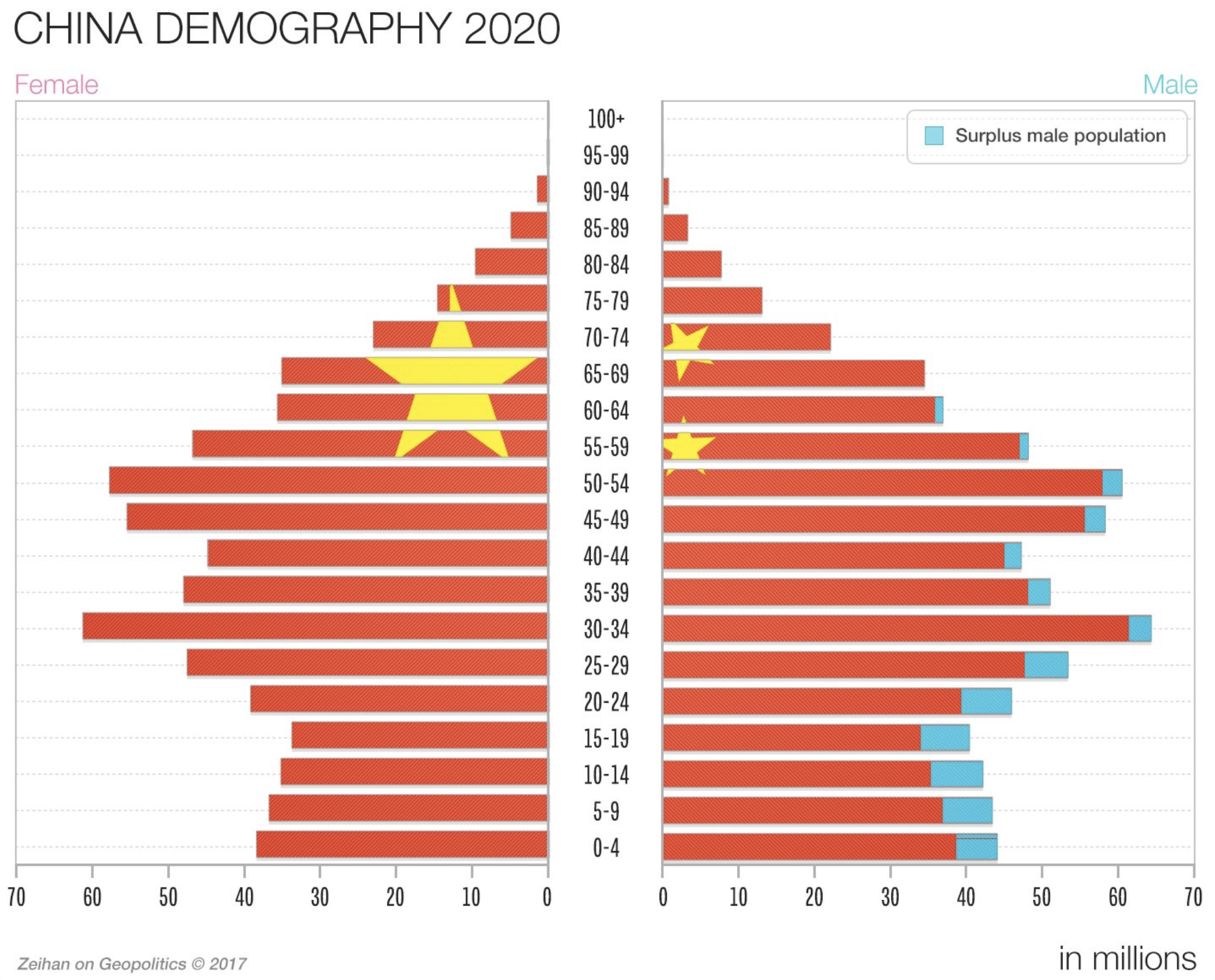

Lets take a step back in time for a moment to show why the CCP is so dangerous. It is not based on strength, but on desperation as you can see from the demographic chart above.

After World War II China had their communist revolution. In 1972, Nixon brought China into world trade. Chinese baby boomers at the time left their farms, and started building cities and factories as China industrialized to become the manufacturer of the world. Part of that was the one child policy enacted in 1980. If you are a peasant farmer then you need children for farm work, if your communist government now wants you to be a factory worker and live in an apartment then you may have one child.

The implicit compact between the CCP and Chinese society is give up political determination for economic improvement in your life.

But that compact is now falling apart because of policies enacted forty years ago.

While US millennials may resent Boomers for continuing to bail themselves out on our backs, at least we are roughly the same size by population and we know we are 1-2 elections away from putting an end to this eternal youth nonsense from Boomers.

That will never happen in China, the millennials will be crushed under the needs of their parents aging population.

But that is just the start of the problem.

CCP Boomers didn’t just have one kid, they all wanted boys, so they practiced single sex abortion.

So if you are a millennial Chinese dude, you have to support twice as many old Chinese, live in a surveillance state run by a communist Politburo, and you have a hard time getting a date and a job since all the factory owners prefer women to work there since they don’t cause problems like a bunch of single dudes in their late 20’s that hate their parents for killing off all the hot Chinese chicks 25 years ago.

China is not a rising superpower, they are at peak civilization.

It is baked into the cake of demographics and human nature. Now add in a significant number of young men with no hope and no way to get the basics of life and a communist government who’s entire compact was giving up political destiny for economic improvement and China is not a stable society.

In a way, reminds me of Japan at peak civilization after a trade war in the 1930s with the US where they knew they were running out of gasoline so they decided to attack than risk slow decline.

What will the CCP choose? Slow decline or attack? I don’t know, but the fact they are in that position makes them very dangerous, which is why I have the risk rating as high as I do the more I thought about it.

It makes me sad the Chinese people are in that position, they were nothing but absolutely kind, warm, and very outgoing when my buddies and I were there. From laughing at how many bamboo trays we piled up as we crushed dumplings to almost killing myself on the sled ride going down from the top of the Great Wall - no safety railings, hand break barely worked, was absolutely the best ride I’ve ever been on.

I don’t even think they really care about bitcoin, I think they care about total warfare and using whatever tool they can to hurt the global power.

It just so happens that currently the financial center of the global power is onboarding to bitcoin because it is what they need.

So in a way, it is like bitcoin is the exact asset that wall street needs, and if China decides to channel internal unrest outwards, then bitcoin will be a good target to use to hurt the global power.

If I was in charge of the operation in China, I would look for a way to cause a cascading failure once the market capitalizations were large enough between bitcoin and the dollar stable coin market being built out into Eurodollar 2.0 because it would be using Wall Streets greed and desperation against themselves.

By causing a cascading failure in these markets which while decentralized have collateralized loans in place, people would try to withdraw out of dollar stable coins to real dollars, and the goal would be to make the failure large enough to cause a real liquidity crisis which the Federal Reserve could not backstop. Of course to do this the market capitalization would have to be in the trillions, but with near zero interest rates in the bond market, money goes where it is treated best, and it is only a matter of time until real money starts flowing over to dollar stablecoins. The question would be how many trillions it would have to be to cause a failure the Fed could not backstop quickly.

I could be completely wrong and maybe bitcoin is not a target, but I know if I was given the mission of finding a target which had the potential to cause massive systemic disruption to the enemy, it would be worth studying because you are attacking the one thing that people believe in who chose to opt out instead of radicalizing within society.

If you can damage bitcoin, you would not just be ruining financially those who chose to opt out, you would be driving them right into the arms of the radical portions of their populations to further destabilize society and politics.

In effect, it would be a way for the CCP to gain the external space needed as their enemies turn inwards.

I have never wanted to be more wrong in my life. Writing some of this feels like I am Tom Clancy writing Debt Of Honor seven years before 9/11.

Nice thing if I am wrong, we all get rich. But the CCP is a demographic time bomb, they are a risk to their own people and others.

So what am I going to do after thinking about all this? I am working on that 100-year portfolio sooner than I thought to be more balanced across all risk environments for deflation, inflation, and growth so no matter what happens I still win.

See you out there, Radigan